Sidee loo xisaabiyaa cashuurta Australia iyo GST marka aad Shiinaha ka soo dhoofsato Australia?

Canshuurta Australiya/GST waxa lasiiyaa kastamka AU ama dawlada kuwaas oo soo saari doona qaansheegad kadib markaad samayso fasaxa kastamka Australia

Qaansheegga waajibaadka Australiya/GST wuxuu ka kooban yahay saddex qaybood oo kala ah WAAJIBKA, GST iyo Khidmada Gelitaanka.

1.Duty waxay kuxirantahay nooca alaabta.

Laakiin sida Shiinuhu uu heshiis ganacsi xor ah ula saxeexday Australia, haddii aad bixin karto shahaadada FTA, in ka badan 90% badeecadaha Shiinaha waa bilaash. Shahaadada FTA waxaa sidoo kale loo yaqaan shahaadada COO waxaana loo isticmaalaa in lagu muujiyo in alaabta lagu sameeyay Shiinaha.

2.GST waa qaybta labaad ee aad u baahan tahay inaad bixiso kastamka AU marka aad ka soo dhoofsanayso Shiinaha.

GST waa 10% qiimaha xamuulka kaas oo ay fududahay in la fahmo

3.Qaybta gelitaanka waa qaybta saddexaad ee kastamka AU-du ay dalaci doonaan waxaana sidoo kale loogu yeeraa kharashyo kale. Waxay la xiriirtaa qiimaha xamuulka kaas oo inta badan ka bilaabma AUD50 ilaa AUD300.

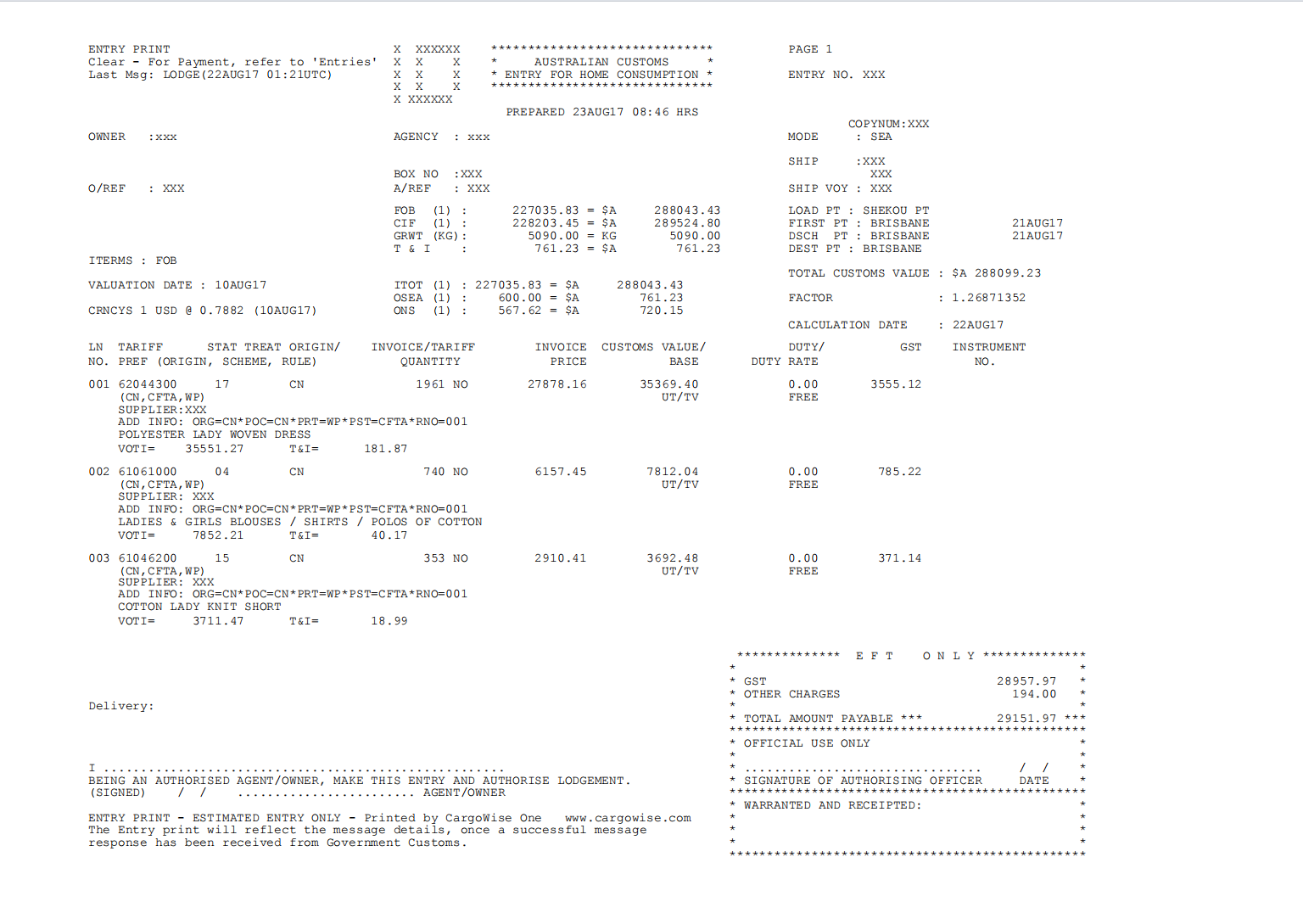

Hoos waxaa ku yaal tusaale qaansheegta cashuurta/gst-ta Australiya oo ay soo saartay kastamka AU:

Si kastaba ha ahaatee, haddii qiimaha xamuulkaagu uu ka yar yahay AUD1000, waxaad codsan kartaa eber AU duty/gst. Kastamka Australia ma soo saari doono qaansheegad

For more information pls visit our website www.dakaintltransport.com or email us at robert_he@dakaintl.cn or telephone/wechat/whatsapp us at +86 15018521480

Waqtiga boostada: Oct-24-2023